With less than two months in 2024, now is the time to talk with your settlement consultant about your fee deferral plan. To defer fees, the final Release must include the proper language.

If it has been a while since you’ve deferred contingency fees or have never chosen the option, here is a quick refresher.

Example: $500,000 Attorney Fee

Let’s say you’re settling a case by the end of this year that will net you a $500,000 contingency fee.

You have two options:

Option #1: Accept the lump sum fee in cash. The $500,000 alone will land you in the 35% federal tax bracket, taking $175,000 off the top. You lose even more of your fee if you are also subject to state income tax.

Option #2: Place your pre-tax fee in a market-based structured settlement, a fixed annuity, or a combination of both. This approach can significantly lower your tax liability since you’ll only pay taxes on the funds received yearly rather than the entire $500,000 lump sum.

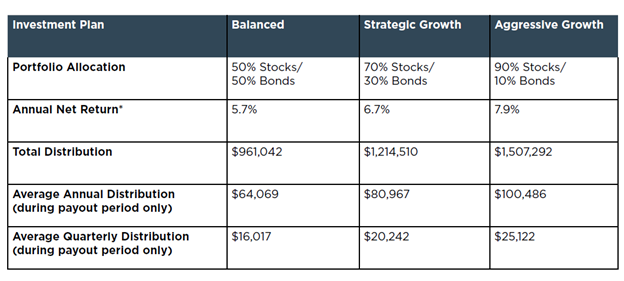

Attorney Fee Deferral Using a Market-Based Structured Settlement

A market-based structured settlement will allow you to take advantage of market-related returns. Unlike a traditional investment made with post-tax dollars, your dollars will grow pre-tax.

This approach allows you to participate in the market but with deferred tax liability and no maximum contribution limit.

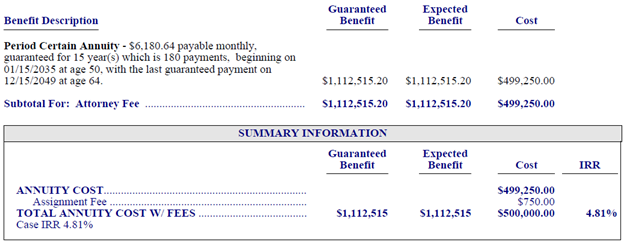

Attorney Fee Deferral Using a Fixed Annuity

A fixed annuity grows at a guaranteed rate. Again, your pre-tax dollars will grow tax deferred.

In the example above, a $500,000 fixed annuity provides $6,180.64 monthly for 15 years beginning at age 50. That’s a 4.81% internal rate of return on your total fee, resulting in more than $600K in additional benefits.

This approach allows you to plan a predictable source of income that you can use over time to supplement your retirement nest egg.

Create a Fee Deferral Plan That Works for You- But Don’t Wait!

Remember—to defer fees, the appropriate language must be included in the Release. Contact your Sage consultant today to learn more about your fee deferral options.