Structured settlement annuity rates are the highest they’ve been in years. If you are a plaintiff attorney interested in structuring your contingency fees or if you have an injured client in need of a long-term income source, now is the time to explore structured settlement annuity options.

What are the benefits of a Structured Settlement Annuity?

Unlike traditional investment vehicles, structures offer:

- Tax-free payments for physical injury cases

- Tax-deferred payments for attorney contingency fees and non-physical injury cases

- No ongoing fees or expenses

- Guaranteed rate of return

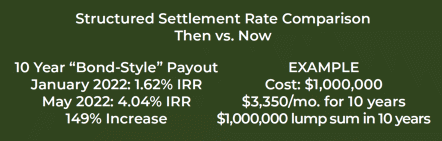

The example below demonstrates the power of structured settlement annuities. Plaintiff attorneys and claimants can enjoy a steady source of tax-free or tax-deferred income and competitive returns.

What is a Structured Settlement Annuity?

A structured settlement annuity provides a series of periodic payments for the annuitant (in this instance, the annuitant is the plaintiff attorney or the claimant). The claimant signs a settlement agreement and release that includes specific language allowing for the claimant and the attorney to structure their funds.

The defendant or insurer then pays the settlement funds directly to a third-party assignment company. The assignment company purchases the structured settlement annuity from a structured settlement provider, who then makes the agreed-upon payments to the annuitant. Structured settlement annuity payments are income tax-free for personal injury, wrongful death, and workers' compensation cases, and income tax-deferred for non-physical injury cases and attorney contingency fees.

Ready to start planning?

Contact your Sage consultant to request a structured settlement annuity illustration today.

Click here to download PDF version.

Please note: Daily rates are subject to change. Contact your settlement consultant for current structured settlement annuity quotes.